The excise tax module

as part of our SAP S/4HANA beverage template

Many luxury foods and stimulants contain an additional tax, for example, tobacco tax, coffee tax, beer tax, etc. This excise tax is imposed directly at the manufacturer’s.

To meet statutory guidelines and optimise communication with the authorities, our customers in the beverage industry are finding it increasingly important to digitalise the sequences linked with the processing of taxes.

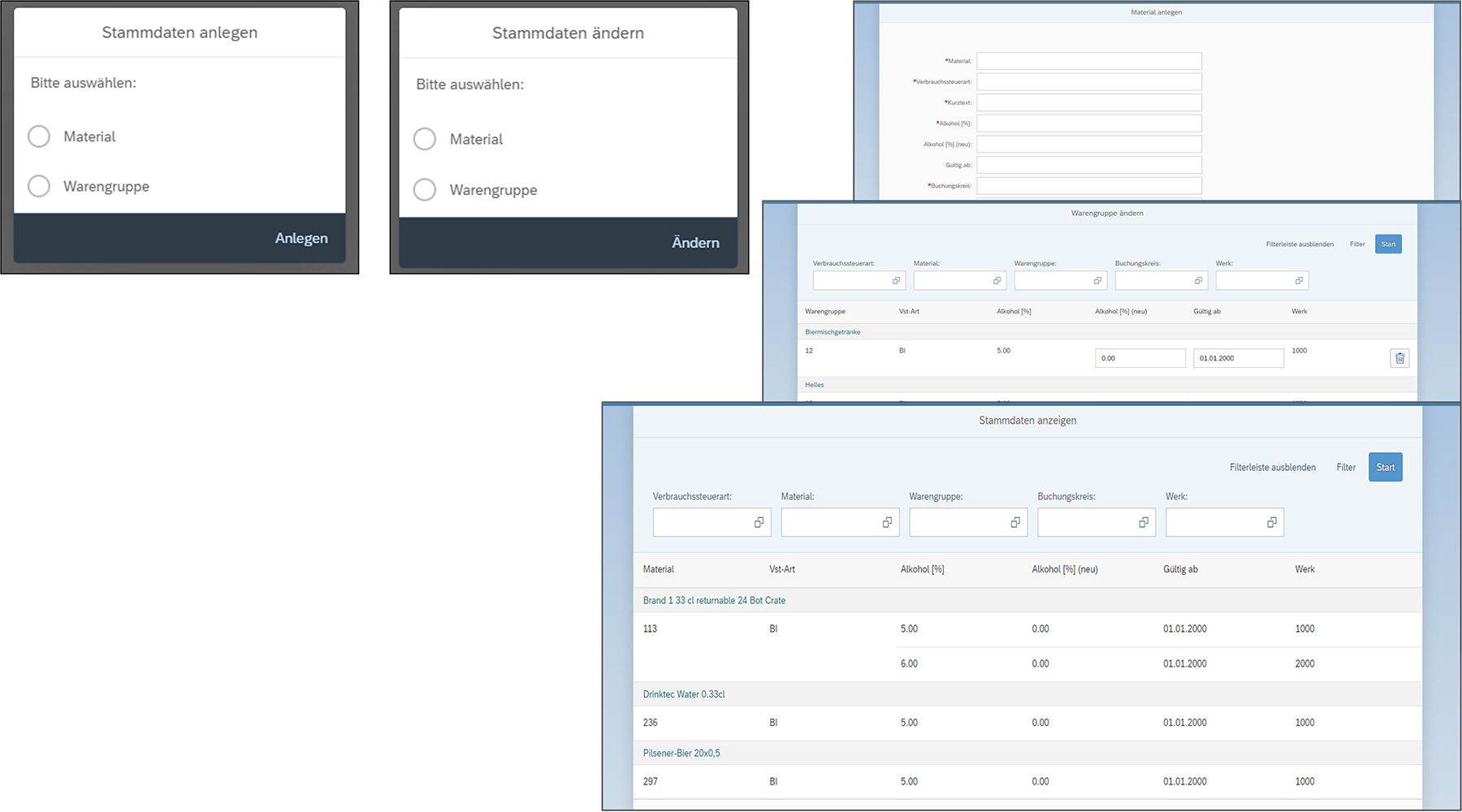

Our solution

- Exclusively on-premise solution: data is saved in the ERP system

- Can be used for ECC 6.0 and S/4HANA

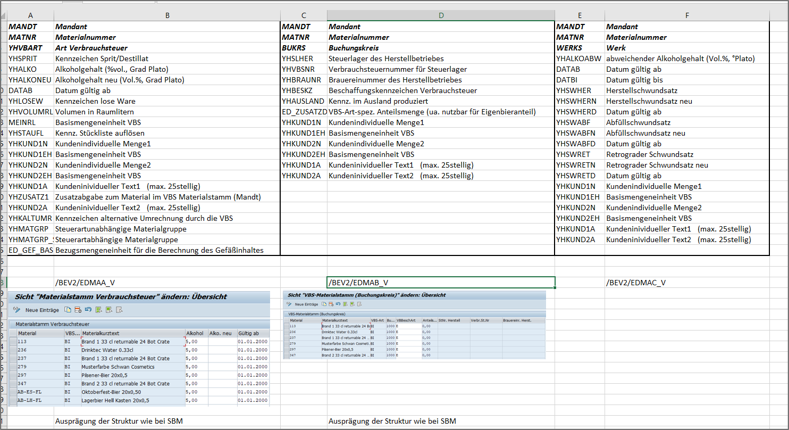

- Document selection based on ECC 6.0 and S/4 structure

- Option of transferring historical data when changing from ECC 6.0 to S/4HANA

- Processing and reposting of incorrect documents

- Manual booking of accruals

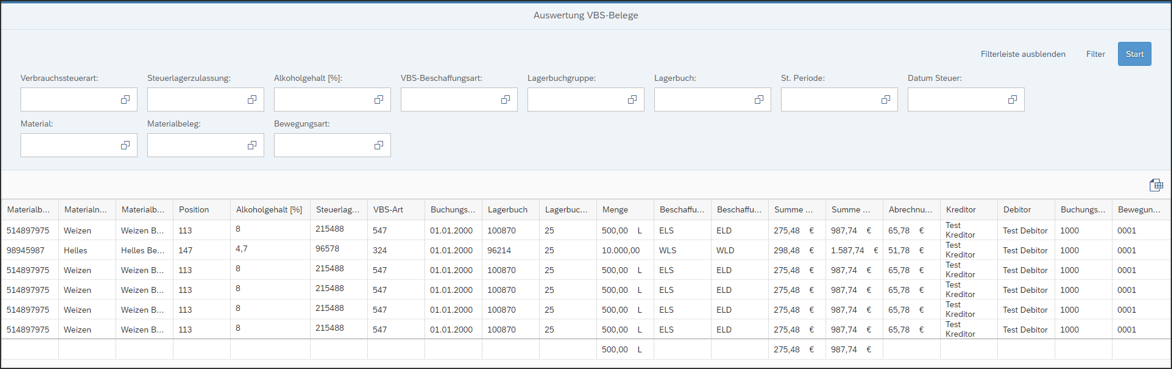

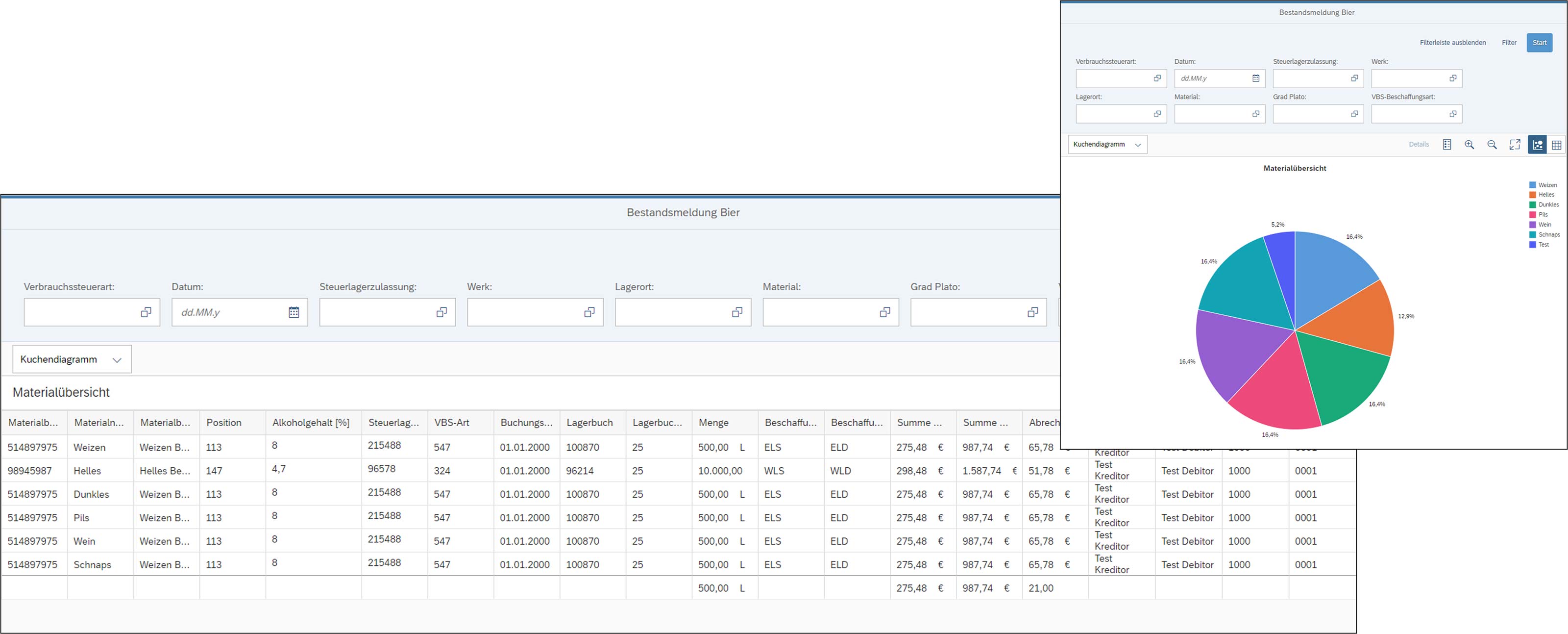

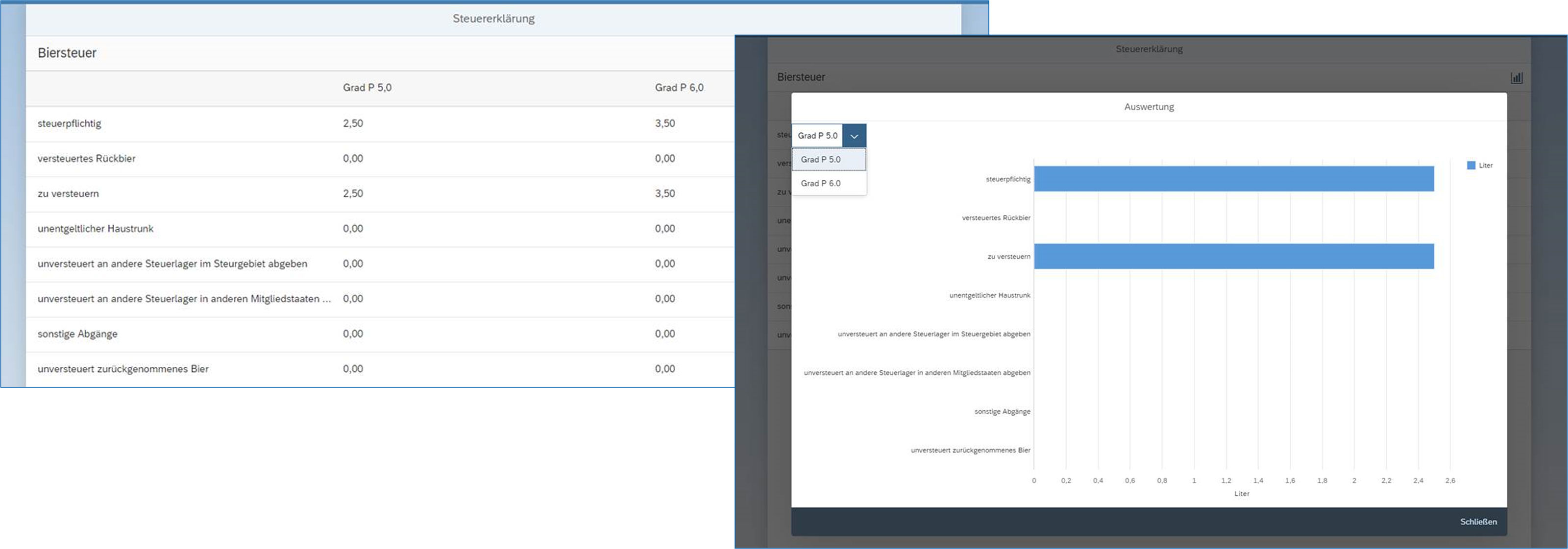

- Evaluations such as the stock book integrated, customer evaluations may be added

- Krones standard solution for meeting the legal requirements

- Customer-specific extensions and adjustments possible

- Unique on the market

Migration concept

Support along the entire excise tax process

Benefits to you

Releasability

Our on-premise solution can be used for ECC 6.0 and S/4 HANA. In addition to a migration concept for historical data, we offer you regular updates and support.

Various industries

Our software is suitable for processing alcohol tax, meaning beer/spirits, sparkling wine and alcopops, the tax for intermediate products, tobacco tax and coffee tax.

Security

Our solution reliably supports you in complying with the statutory regulations.

Flexibility

With customising, you can expand and modify the software to meet your needs, as well as adding individual evaluations.

Implementation

Regardless of whether you need a complete, newly installed SAP system or wish to extend your existing installation, you can benefit from the beverage-specific expertise of our SAP consultants.